INVESTMENT – REAL ESTATE

Investment is an act of committing money or capital to an endeavor with the expectation of obtaining additional income or profit. This definition is provided by the Reserve Bank of India (RBI), and it highlights the basic concept of investment that involves allocating funds with the goal of earning a return on investment over time.

There are various types of investment options available in India, ranging from traditional to modern. Traditional investment options include fixed deposits, post office savings schemes, and public provident funds (PPF), while modern investment options include mutual funds, equity, and venture capital. Both types of investments have their own benefits and drawbacks.

Traditional investments are safe, as they provide guaranteed returns with minimal risk. Fixed deposits and PPF are popular options among risk-averse investors as they provide a fixed return on investment.

Post office savings schemes are also a popular option among investors, especially in rural areas. The total deposits in post office savings schemes stood at Rs. 1.78 lakh crores as of March 2020.

On the other hand, modern investments are more volatile, but they provide higher returns over the long term. Mutual funds, equity, and venture capital are popular investment options among investors looking for higher returns.

The mutual fund industry in India has seen steady growth over the years, with the total assets under management (AUM) reaching Rs. 34.72 lakh crores as of August 2021. Foreign portfolio investors (FPIs) have also been investing in Indian equities, making a net investment of Rs. 12,027 crores in August 2021.

Real estate is a popular investment option in India. The real estate sector is expected to reach a market size of US$1 trillion by 2030, according to the National Real Estate Development Council. Despite the pandemic-induced slowdown, private equity investments in the Indian real estate sector stood at $4.8 billion in 2020.

Residential real estate sales in India reached a 7-year high in 2021, with sales volume increasing by 29% year-on-year in Q2 2021. The average property prices in India’s top 7 cities increased by 5% in 2020, indicating steady growth in the real estate market.

Investing in real estate has its own benefits, such as a steady stream of rental income, potential for capital appreciation, and diversification of investment portfolios. Real estate investment trusts (REITs) have also emerged as a popular investment option, allowing investors to invest in the real estate sector without having to own and manage physical properties.

Investment is a crucial aspect of financial planning, and there are various investment options available in India, including traditional, modern, and real estate. Each investment option has its own benefits and risks, and investors should carefully evaluate their options before making any investment decisions.

With the right investment strategy, investors can earn a significant return on investment over the long term, helping them achieve their financial goals.

Our Offering

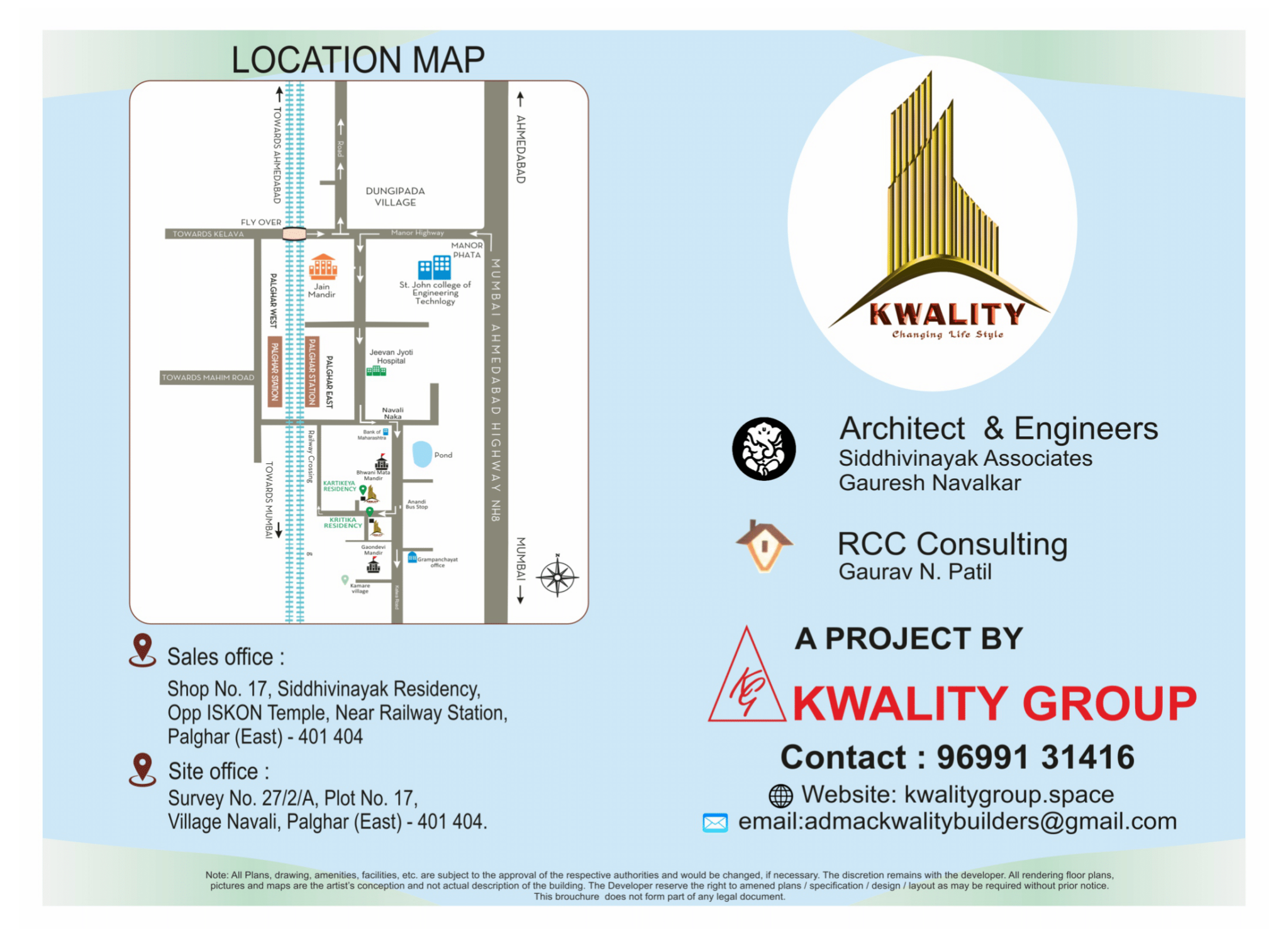

KRITIKA RESIDENCY, PALGHAR (EAST) BY KWALITY GROUP

KARTIKEYA RESIDENCY, NAVALI PALGHAR (EAST) BY KWALITY GROUP

For more information

Importance of Investment in Real Estate

Steady Flow of Cash

Real estate investments can provide a steady stream of rental income, generating passive income for investors.

Appreciation in Value

Real estate has the potential to appreciate in value over time, providing investors with capital gains when they sell the property.

Diversification & Control

Real estate can help diversify an investment portfolio, reduce overall risk, and provide investors with control over their investment through property management, renovations, and tenant selection.

Frequently Asked Questions

Investment refers to the act of allocating money or capital with the expectation of generating income or profit. It can take many forms, including stocks, bonds, real estate, mutual funds, and other financial instruments.

Real estate investment offers long-term appreciation, passive income, and tax advantages.

Real estate investment is not liquid, can require significant capital, and may be impacted by market fluctuations.

Real estate investments can be made in residential, commercial, industrial, and raw land properties.

Real estate investments can be financed through mortgages, personal funds, or partnerships.

Investors should consider location, property condition, rental demand, and potential for appreciation.

Return on investment is calculated by subtracting expenses from income and dividing the result by the property value.

Rental property management involves setting rental rates, screening tenants, and maintaining the property.

Real estate investment offers tax deductions for mortgage interest, property taxes, and depreciation.

REITs allow investors to invest in a portfolio of real estate properties without owning the property themselves.

Real estate agents can assist investors in identifying investment opportunities and negotiating deals.

A property inspection evaluates the condition of the property and can identify potential issues before purchasing.

A property appraisal determines the value of the property and can help investors determine a fair purchase price.

Investors should consider zoning laws, property taxes, and any existing contracts or leases.

Investors can mitigate risks by conducting due diligence, diversifying their portfolio, and purchasing property insurance.

Investors can exit a real estate investment by selling the property, refinancing, or exchanging it for another property.

Investors can invest in real estate through crowdfunding platforms or purchase a fraction of a property.

Purchasing a property at auction involves research, attending the auction, and securing financing.