Mutual Funds are subjected to market risk. Kindly read the document carefully

MUTUAL FUNDS

Mutual funds have become a popular investment option for many individuals in India due to their potential for higher returns and diversification benefits. The Securities and Exchange Board of India (SEBI) defines a mutual fund as “a mechanism for pooling the resources by issuing units to the investors and investing the funds in securities by the objectives as disclosed in the offer document.”

One of the key advantages of mutual funds is their ability to diversify investments across a range of securities such as stocks, bonds, and money market instruments, thus spreading the risk. Additionally, mutual funds are managed by professional fund managers who have expertise in analyzing the markets and choosing the best investment options for the fund.

According to data from the Association of Mutual Funds in India (AMFI), the mutual fund industry in India has witnessed significant growth in recent years. As of December 2021, the total assets under management (AUM) of the mutual fund industry stood at Rs. 37.82 lakh crore, representing a YoY growth of 26.3%. Equity-oriented funds and balanced funds have been the most popular categories among investors, accounting for over 40% of the total AUM.

The increasing participation of retail investors in the mutual fund industry, according to a report by the National Stock Exchange (NSE), the number of mutual fund folios (or investor accounts) in India increased by 26% YoY to reach 11.78 crores in December 2021. This trend is a testament to the growing awareness and interest of Indian investors in mutual funds as an investment option.

Moreover, mutual funds have played a crucial role in channeling funds into the Indian capital markets, thereby supporting the growth of the economy. As per SEBI data, mutual funds were among the top three categories of institutional investors in Indian equities in December 2021, with a share of 12.4% in the total market capitalization.

Mutual funds offer a range of benefits such as diversification, professional management, and the potential for higher returns. With the growing participation of retail investors and the industry’s robust growth, mutual funds are becoming an increasingly popular investment option in India. However, as with any investment, investors need to do their research and understand the risks involved before investing in mutual funds.

Our Offering

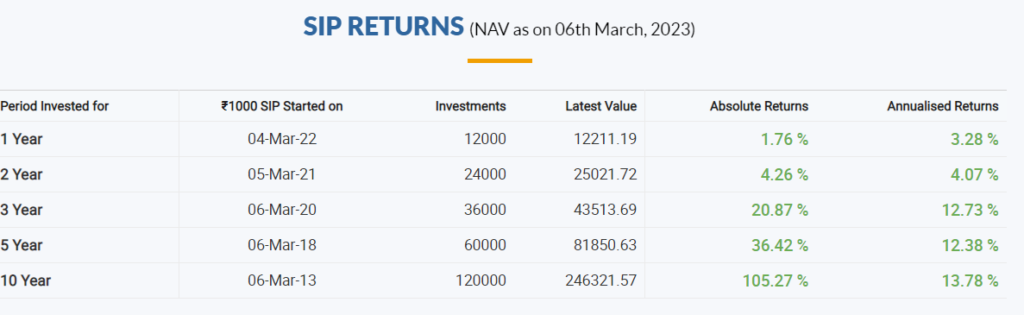

Mirae Asset Mutual Fund

| Investment Strategy |

| Invests > 80% in large cap stocks (Top 100 companies by market capitalization). |

| Aims to combine consistency of large caps with few conviction midcap ideas (upto a max of 20%). |

| Fund has flexibility to invest across sectors and themes. |

| The investment approach is centered around participating in high quality businesses upto a reasonable price and holding the same over an extended period of time. |

| The scheme tries to identify companies which have sustainable competitive advantage – stocks which has strong pricing power and are sector leaders. |

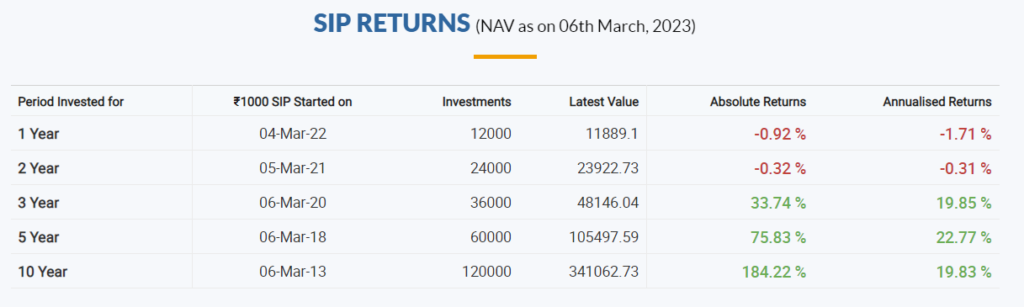

Axis Mutual Fund

Investment Objective- To achieve long term capital appreciation by investing in a diversified portfolio predominantly consisting of equity and equity related securities of Large cap companies including derivatives.

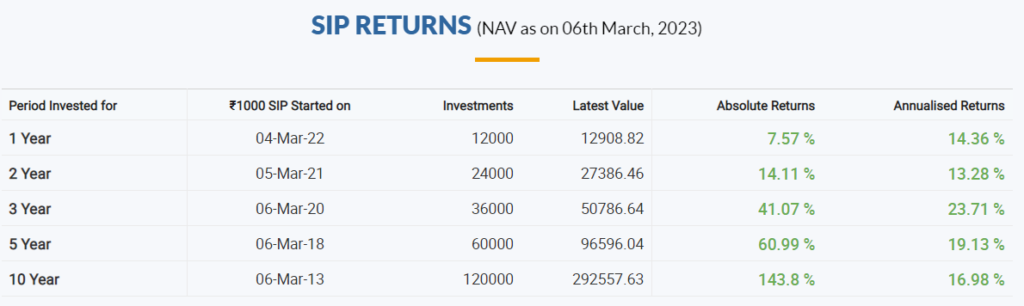

ICICI Prudential Mutual Fund

ICICI Prudential Technology Fund

Investment Objective:

To generate long-term capital appreciation by creating a portfolio that is invested in equity and equity-related securities of technology and technology depended companies.

HDFC Mutual Fund

HDFC Mid-cap Opportunity Fund:

The Scheme shall follow a predominantly Mid cap strategy with a minimum exposure of 65% to Mid-Cap stocks. The Scheme may also seek participation in other equity and equity related securities to achieve optimal portfolio construction.

The aim of equity strategy will be to predominantly build a portfolio of mid-cap companies which have:

a) reasonable growth prospects

b) sound financial strength

c) sustainable business models

d) acceptable valuation that offers potential for capital appreciation.

SBI Mutual Fund

1.SBI Small Cap Fund aims to provide investors with opportunities for long-term growth in capital by investing predominantly in a well-diversified basket of equity stocks of small cap companies.

2.The fund predominantly invests (minimum 65%) in small cap stocks.

3.SBI Small Cap Fund can also take up to 35% exposure in other equities (including large and mid-cap companies) and/or debt and money market instruments.

4.The fund follows a blend of growth and value style of investing and will follow bottom-up investment strategy for stock selection.

We provide all the schemes avaliable in the market, feel free to get in touch with us for any assistance

For more information

Importance of Mutual Funds for you

Diversification & Professionally Managed

Mutual funds are professionally managed and provide diversification, reducing investment risk and making it easier for investors to achieve their financial goals.

Convenience & Accessibility

Mutual funds offer convenient and accessible investment options, can buy and sell shares at any time, and can make regular contributions through a Systematic Investment Plan (SIP).

Potential of Higher Returns

Mutual funds have the potential to deliver higher returns and offer tax benefits, making them an attractive investment option for many people.

Frequently Asked Questions

Mutual funds are professionally managed investment schemes that pool money from investors to invest in a diversified portfolio of stocks, bonds, or other securities.

There are different types of mutual funds available such as equity funds, debt funds, hybrid funds, index funds, sectoral funds, etc.

The advantages of investing in mutual funds are diversification, professional management, affordability, liquidity, and transparency.

The risks associated with investing in mutual funds are market risks, interest rate risks, credit risks, inflation risks, and liquidity risks.

To choose the right mutual fund for your investment goals, you need to consider factors such as your risk appetite, investment horizon, financial goals, and investment objectives.

Mutual funds are taxed differently based on the type of fund and the holding period. Short-term capital gains tax is applicable for a holding period of fewer than 36 months, and long-term capital gains tax is applicable for a holding period of more than 36 months.

Mutual funds cannot guarantee returns as they are subject to market risks. The returns generated by mutual funds are dependent on the performance of the underlying securities in the portfolio

Open-ended mutual funds can be bought and sold at any time, while closed-ended mutual funds have a fixed number of units that are issued and can be bought and sold only on stock exchanges.

To redeem mutual fund units, investors need to submit a redemption request to the fund house. The units will be redeemed and the proceeds will be credited to the investor’s bank account within a few working days.

Yes, investors can switch between different mutual funds by submitting a switch request to the fund house. Some fund houses may charge a nominal fee for switching.

The Net Asset Value (NAV) of a mutual fund is the market value of the fund’s assets minus its liabilities divided by the number of units outstanding.

It is recommended to review your mutual fund portfolio at least once a year, or whenever there are significant changes in your financial goals, risk appetite, or investment horizon.

The advantages of investing in mutual funds compared to other investment options are diversification, professional management, liquidity, and affordability. The disadvantages are market risks, fees and charges, and lack of control.

Yes, investors can invest in mutual funds through a Systematic Investment Plan (SIP) which allows for regular investments at fixed intervals.

The different fees and charges associated with investing in mutual funds are expense ratio, exit load, and transaction charges.

The Expense Ratio is the annual fee charged by the fund house to manage the mutual fund. A higher expense ratio can impact the overall returns generated by the mutual fund.

You can compare the fund’s performance against its benchmark index and other similar funds in its category. Look for consistency in performance over different time periods.

Yes, NRIs are allowed to invest in mutual funds in India subject to certain regulations.

No, a PAN card is mandatory for investing in mutual funds.

An SWP allows you to withdraw a fixed amount of money from a mutual fund at regular intervals, typically monthly. This is useful for generating regular income from your mutual fund investments.

Yes, mutual funds allow for joint investments with one or more individuals.

Mutual funds are ideal for long-term investments, typically for a period of at least 5-7 years or more. but it also depends on your goals of investment