What is an insurance policy

Introduction and Explanation of what is an insurance policy

According to the Insurance Regulatory and Development Authority of India (IRDAI), insurance is defined as “a contract between the insurer and the insured, whereby the insurer undertakes to pay the insured, or his beneficiary, a certain sum of money upon the happening of a specified event, in consideration of the premium paid by the insured.”

An insurance policy is a legally binding agreement between the insured and the insurance provider. The policyholder pays a premium under this contract, and the insurance company guarantees to pay a lump sum payment in the case of an unforeseen catastrophe.

Consider the following scenario: you are driving your automobile when an accident occurs. In this case, an insurance policy serves as a safety net, covering all medical expenditures, repair charges, and other connected costs. This is only one of many advantages that insurance policies provide.

In this article, we’ll go over what is an insurance policy, what it covers, and how it operates. We will also go through the many types of insurance plans, their advantages, and how to pick the best coverage for your specific requirements. You will have a better grasp of insurance coverage and be better ready to make an informed decision by the conclusion of this article.

Types of Insurance policy

There are different types of insurance policies available in india. Lets get to know them

1. Life Insurance

Life insurance is a contract between the policyholder and the insurance company in which the insurer guarantees payment of a death benefit to designated beneficiaries following the insured person’s death. In return for coverage, the policyholder pays a premium. Life insurance policies come in a variety of forms, including term life insurance, whole life insurance, and endowment plans.

2. Health Insurance

Health insurance is a form of insurance policy that covers the policyholder’s medical expenditures. In return for the coverage, the policyholder pays a premium to the insurance company. Up to the policy’s coverage limit, the insurance company pays for the policyholder’s medical expenditures. Individual health insurance, family floater, and critical sickness insurance are among the numerous types of health insurance policies available.

3. Car Insurance

Car insurance is a form of insurance coverage that protects your car financially. In return for the coverage, the policyholder pays a premium to the insurance company. In the case of an accident or theft, the insurance provider covers any damages or losses to the policyholder’s car. Third-party insurance, comprehensive insurance, and personal accident insurance are all options for automobile insurance coverage.

4. House Insurance

Home insurance is a form of insurance coverage that protects your home and its belongings financially. In return for the coverage, the policyholder pays a premium to the insurance company. In the case of an accident or theft, the insurance company compensates for any damages or losses to the policyholder’s house and its contents.

5. Travel Insurance

A form of insurance policy that covers medical bills, trip cancellations, lost or stolen luggage, and other travel-related catastrophes. In return for the coverage, the policyholder pays a premium to the insurance company. In the event of a covered incident, the insurance company compensates the policyholder’s expenditures.

6. Personal Accident Insurance

Personal accident insurance is a form of insurance policy that covers accidental death or complete and permanent disability. In return for the coverage, the policyholder pays a premium to the insurance company. In the case of accidental death or permanent complete disability, the insurance company pays a lump amount to the insured or their beneficiaries.

7. Bike Insurance

Bike insurance, often known as two-wheeler insurance, is a sort of insurance coverage that offers financial protection for damages or losses caused by the covered bike as a result of unanticipated occurrences such as accidents, theft, natural disasters, and so on. In India, third-party liability insurance is required by law, although comprehensive insurance is optional.

8. Miscellaneous Insurance

Miscellaneous insurance is a form of insurance policy that covers a variety of non-life insurance goods, such as boat insurance and mobile phone insurance. In return for the coverage, the policyholder pays a premium to the insurance company. In the event of a covered incident, the insurance company compensates the policyholder’s expenditures.

There are various types of insurance policies available in India, each providing coverage for different aspects of a policyholder’s life. It’s important to understand the different types of insurance policies and choose the right one to meet your specific needs and protect your financial future.

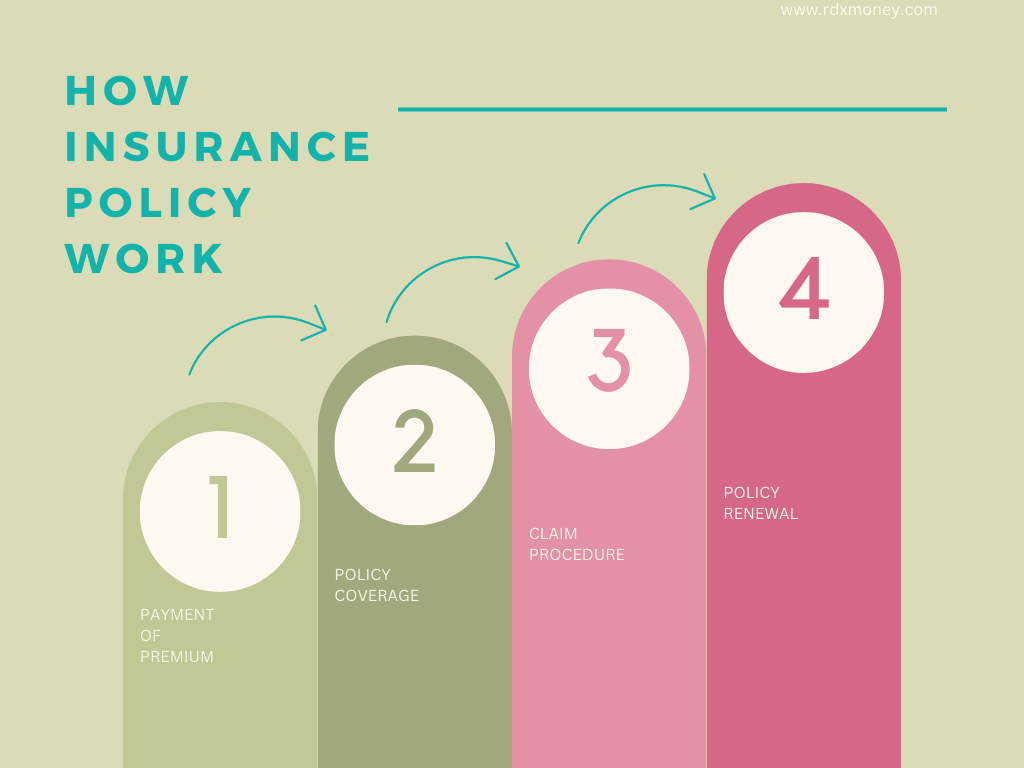

How insurance policy works

Insurance plans function by offering financial security in exchange for a premium payment. The amount of money the insurance company agrees to pay out in the case of a claim is defined as policy coverage, and the claim procedure comprises the policyholder presenting paperwork and the insurance company reviewing and accepting the claim. Let us understand the step in a little more detail.

1. Payment of Premium

A premium is the amount of money paid to the insurance company in exchange for coverage. This payment is made on a regular basis, such as monthly, quarterly, or annual basis. The premium amount is determined by several criteria, including your age, health, insurance type, and coverage quantity.

2. Policy Coverage

The amount of money that the insurance company agrees to pay out in the case of a claim is referred to as policy coverage. This sum is defined in the insurance policy and is calculated depending on the premium payment. For example, if you have a 1 crore life insurance policy, the insurance company will pay you 1 crore in the case of your death.

3. Claim Procedure

If a claim is filed, the policyholder must inform the insurance company and provide the requisite evidence. The insurance company will next investigate the claim to see if it is covered by the policy. If the claim is allowed, the insurance company pays the policyholder or the selected beneficiary the policy coverage amount.

4. Policy Renewal

Most insurance plans are good for a set length of time. The policyholder might opt to renew the policy for another term at the end of the policy period. The premium amount may vary at renewal depending on the insurance company’s risk assessment of the policyholder.

Insurance policies work by providing financial protection in exchange for a premium payment. The policy coverage is the amount of money the insurance company agrees to pay out in the event of a claim, and the claim process involves the policyholder providing documentation and the insurance company investigating and approving the claim.

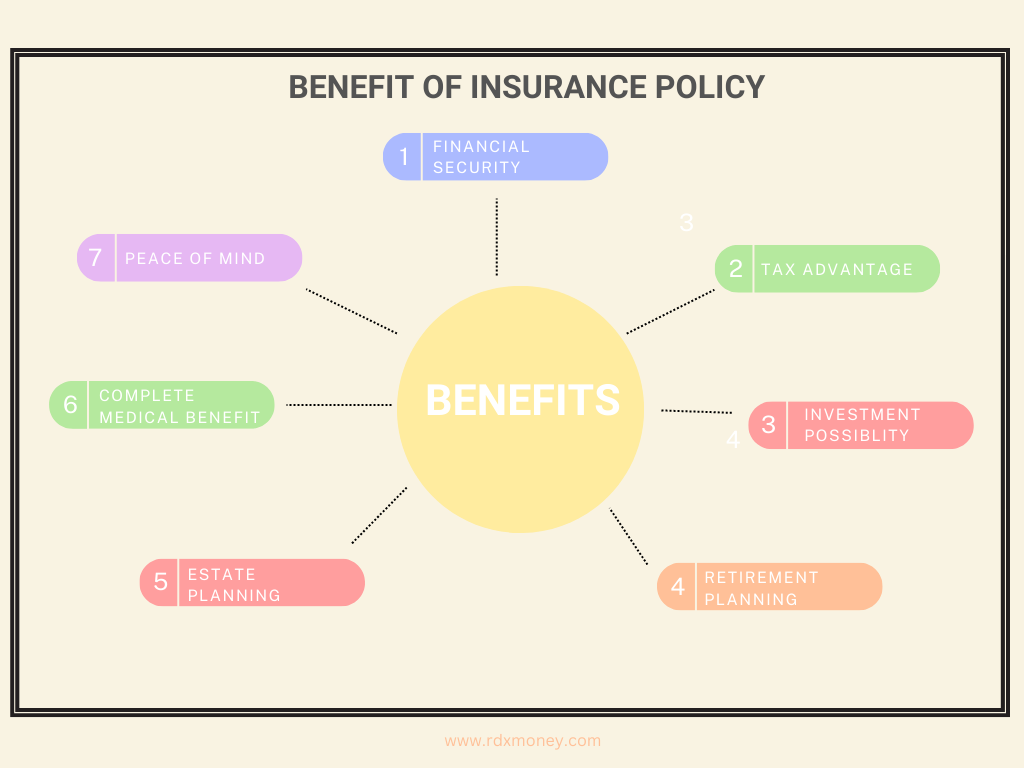

Benefits of Insurance Policy

There are various advantages to having an insurance policy, which may offer policyholders financial security and peace of mind. Consider the following significant advantages:

1. Financial Security

Financial security is one of the most important advantages of having insurance coverage. Life insurance products cover your family financially in the event of your death, whilst health insurance policies protect you against the exorbitant expenses of medical care.

2. Tax Advantage

Insurance plans provide tax advantages to policyholders. Premiums paid for life insurance contracts are deductible under Section 80C of the Income Tax Act, after April 1 , 2023, only annual premium of more than Rs 5 Lakh will now be taxable. whereas maturity benefits are tax-free under Section 10(10D) of the Income Tax Act.

3. Investment Possibility

Several insurance policies, including endowment plans and unit-linked insurance plans (ULIPs), provide investment opportunities. Policyholders can invest in this insurance and get a return on their investment.

4. Retirement Planning

Insurance plans can also be utilized to plan for retirement. Insurance firms’ pension schemes provide policyholders with a consistent income during their retirement years.

5. Estate Planning

Life insurance plans can also be utilized to prepare an estate. Beneficiaries can utilize the death benefit to pay off existing debts and other financial commitments, or to offer financial stability to the family.

6. Comprehensive Medical Benefits

Insurance plans can provide comprehensive medical benefits in addition to financial protection in the event of unforeseen medical bills. Coverage may include routine check-ups, preventative care, and specialist appointments. This can assist policyholders in managing their health and well-being, ensuring they obtain the medical treatment they require when they require it. Furthermore, comprehensive medical benefits can help policyholders save money on out-of-pocket medical care charges, making it simpler to maintain their health and well-being.

7. Peace of Mind

Having an insurance policy gives policyholders peace of mind since they know their financial stability and well-being are taken care of. Life insurance plans give financial protection to the family in the event of death, whilst health insurance policies cover the high expenses of medical care.

Insurance plans include a number of benefits that can help people and families manage their money, health, and overall well-being along with peace of mind and security they need to live their lives to the fullest, whether via financial protection, investment opportunities, or comprehensive medical care.

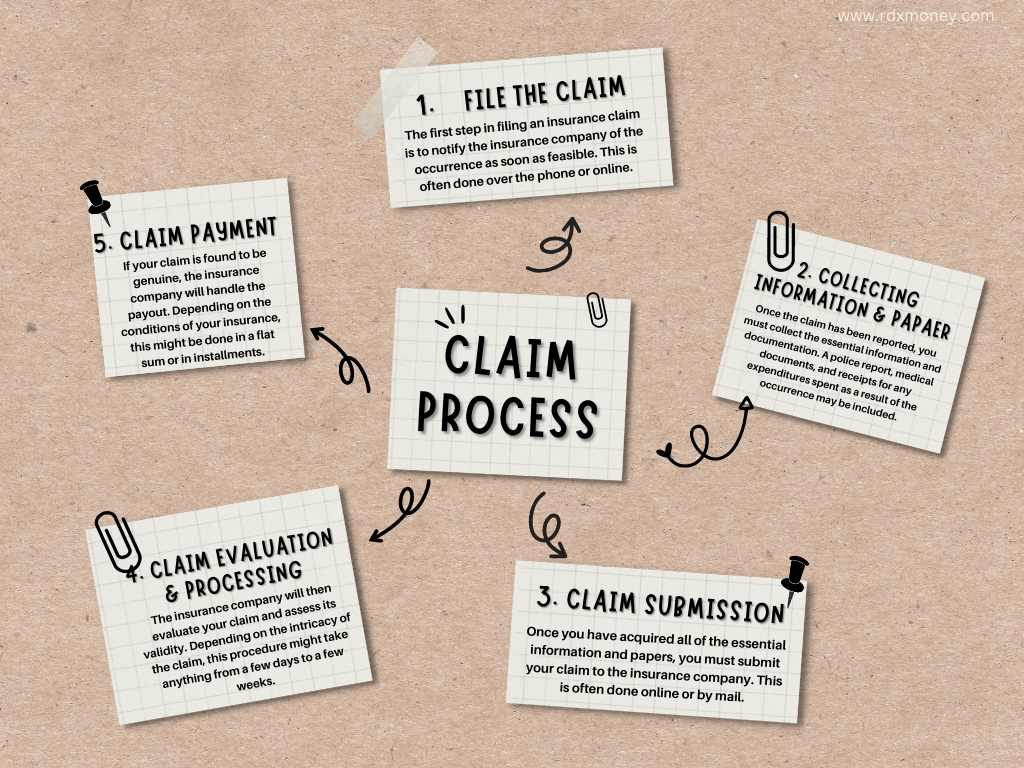

Insurance Claim Process

For individuals who are new to the insurance claim procedure, it may be a complex and complicated process. But, with proper planning and awareness of the procedures required, the process may be greatly simplified. This section will go over the process of filing an insurance claim, including the documentation needed and the actions involved.

1. File the Claim

The first step in filing an insurance claim is to notify the insurance company of the occurrence as soon as feasible. This is often done over the phone or online. For example, if you are in a vehicle accident, you would notify your auto insurance company.

2. Collecting Information and Papers

Once the claim has been reported, you must collect the essential information and documentation. A police report, medical documents, and receipts for any expenditures spent as a result of the occurrence may be included. For example, if you are filing a health insurance claim for a hospital stay, you must supply your medical documents as well as hospital bills.

3. Claim Submission

Once you have acquired all of the essential information and papers, you must submit your claim to the insurance company. This is often done online or by mail. If you are making a life insurance claim for a deceased loved one, for example, you will need to present a death certificate and other appropriate evidence.

4. Claim Evaluation and Processing

The insurance company will then evaluate your claim and assess its validity. Depending on the intricacy of the claim, this procedure might take anything from a few days to a few weeks. For example, if you file a claim for storm damage on your property, the insurance company would dispatch an adjuster to inspect the damage before reaching a decision.

5. Claim Payment

The insurance company will handle the payout if they find your claim to be genuine. Depending on the conditions of your insurance, they may pay it in a flat sum or in installments.If you file a disability insurance claim, for example, the payment will be provided on a regular basis until you are able to return to work.

The insurance claim process might be intimidating, but with proper preparation and awareness of the stages involved, it can be a lot simpler. You can assure a smooth and successful insurance claim procedure by following the steps indicated above and supplying all the relevant information and paperwork.

Choosing the Right Insurance Policy

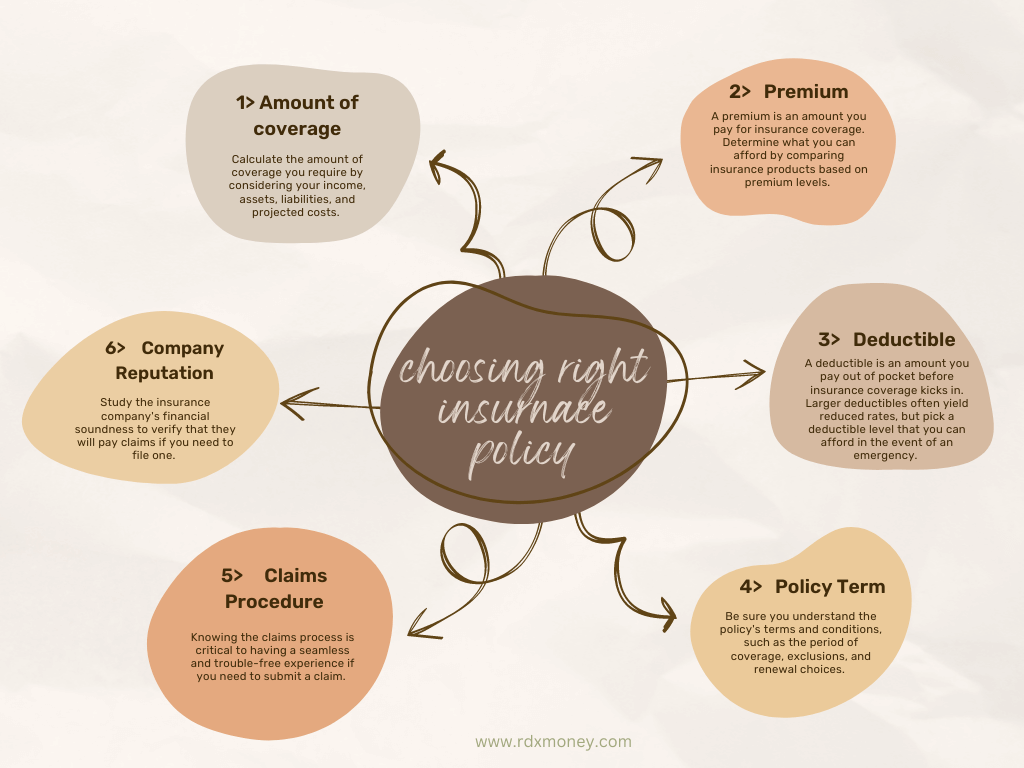

Selecting the correct insurance policy is critical to ensure you have adequate coverage and protection. While selecting insurance coverage, there are various aspects to consider which are as follows-

1. Amount of Coverage

Calculate the amount of coverage you require by considering your income, assets, liabilities, and projected costs. If you own a home, for example, you should consider purchasing a home insurance policy that covers the entire replacement cost of your property in the case of a catastrophic loss.

2. Premiums

A premium is an amount you pay for insurance coverage. Determine what you can afford by comparing insurance products based on premium levels. For example, if you have a limited budget, you may prefer insurance with cheaper rates, but keep in mind that lower premiums may imply less coverage.

3. Deductibles

A deductible is an amount you pay out of pocket before insurance coverage kicks in. Larger deductibles often yield reduced rates, but pick a deductible level that you can afford in the event of an emergency. If you have a medical insurance claim amount of Rs. 2,50,000 and your policy’s deductible quantity is Rs. 50,000, then you will pay Rs.50,000 while the medical insurance company will pay the balance amount of Rs. 2,00,000.

4. Policy Term

Be sure you understand the policy’s terms and conditions, such as the period of coverage, exclusions, and renewal choices. If you have a term life insurance policy, for example, be sure you understand how it will renew, if it will renew at all, and what the premiums will be after the original period.

5. Claims Procedure

Knowing the claims process is critical to having a seamless and trouble-free experience if you need to submit a claim. For example, if you have automobile insurance, be sure you know what actions to take in the case of an accident and what evidence you must present to the insurance provider.

6. Insurance Company Reputation

Study the insurance company’s financial soundness to verify that they will pay claims if you need to file one. For example, if you’re thinking about buying life insurance from a specific firm, look into their ratings from organizations like A.M. Best, Standard & Poor’s, and Moody’s to determine their financial health and capacity to pay claims.

By taking these aspects into account and evaluating different insurance policies, you may select the best policy for your specific needs, ensuring that you get the coverage and protection you require.

Conclusion

Insurance is a type of risk management that offers financial protection against unforeseeable catastrophes or losses. It is critical to select the best insurance policy for an individual’s needs and budget, taking into account criteria such as coverage quantity, premiums, deductibles, policy terms, claims procedure, and insurance company reputation.

Understanding the insurance policy and its terms and conditions is critical in order to avoid confusion or conflicts during a claim. Before making a final selection, it is essential that you evaluate several insurance products. Overall, insurance acts as a safety net for individuals and organizations, helping them to reduce financial risks and safeguard their assets.

If you are not able to understand and come to a decision do ask the agent or get in touch with those people who are into this field and understand the different aspects of insurance and its working. It is always better to make an informed decision so that you can secure your future with right kind of insurance policy.

Frequently Asked Questions

After acquiring your insurance coverage, you can make changes to it, but you might incur costs or penalties. Your coverage or rates can affect by any modifications you make. To understand the consequences and ensure that the changes are suitable for your needs, consult with your insurance agent or company before making any policy changes.

The insurance company determines your insurance rates based on various factors, such as your age, gender, health condition, location, and the amount of coverage you select. They may also consider your driving record, credit score, profession, and lifestyle choices. You can lower your insurance prices by selecting a higher deductible or consolidating multiple plans with the same insurer.

You require a specific amount of coverage based on your individual circumstances, such as your assets, liabilities, and potential risks. You should evaluate your current financial situation and determine the coverage amount you would need in the event of a loss. An insurance agent or financial advisor can assist you in determining the appropriate level of coverage

You have the right to terminate your insurance coverage at any time, but cancellation fees or penalties may apply, and any earned perks or discounts may be forfeited. Before canceling your policy, it’s important to carefully evaluate the consequences and consider whether there are other coverage options available.

You must make premium payments on time to maintain your insurance coverage. Failure to do so can result in your coverage being cancelled or lapsing