What is health insurance- A Beginner’s Guide

What is health insurance

According to the Insurance Regulatory and Development Authority of India, “Health insurance is an insurance policy that covers medical expenses incurred by the policyholder during the policy period. It reimburses the policyholder for expenses incurred from illness or injury or pays the care provider directly.” According to IRDAI in 2020-21, the health insurance business in India will expand by 20%, with a total premium of Rs. 61,214 crores. This shows that an increasing number of individuals understand the value of health insurance.

Health insurance is a critical component of financial planning. With the escalating cost of healthcare services in India, having health insurance can safeguard individuals and families from financial hardship in the event of a medical emergency. It gives people financial stability by covering the costs of medical care and hospitalization.

In this blog, we will look at the many features of health insurance in India, such as the different types of plans, perks, coverage, and the process of purchasing a health insurance policy. So let us get started and discover more about health insurance in India.

Importance of Health Insurance in India

In today’s environment, having health insurance policy has become a must. It offers financial security in the case of a medical emergency and assures that individuals may access critical medical treatment without fear of financial hardship. Having health insurance is more crucial than ever in India, where healthcare prices are continually growing.

According to a National Sample Survey Organisation (NSSO) estimate, over 85% of the rural population and 82% of the urban population in India lack health insurance. Families that must pay for medical expenditures out of their own wallets have a huge financial burden as a result. This can force families into debt, poverty, or even bankruptcy in many circumstances.

Furthermore, the COVID-19 epidemic has emphasized the significance of obtaining health insurance policy. Many patients afflicted with the virus needed to be hospitalized, and the expense of treatment might be excessive. Those having health insurance could undergo essential care without fear of financial repercussions, whilst those without insurance had to pay for it themselves.

In general, health insurance policy is critical for individuals and families in India. It protects families financially in the case of a medical emergency, assures access to quality healthcare, and keeps families from falling into poverty or bankruptcy. In the parts that follow, we will look at the many forms of health insurance available in India, as well as the pros and downsides of each.

Types of Health Insurance in India

Health insurance plans come in many formats and include various sorts of coverage. The most prevalent forms of health insurance plans coverage available in India are listed below.

1. Individual Health Insurance Policy

As the name implies, an individual health insurance policy is meant to cover a single person. The policyholder pays an insurance premium to the firm, which covers the expense of medical care in the event of hospitalization or another medical emergency. According to the Insurance Regulatory and Development Authority of India (IRDAI), the number of individual health insurance plans in place in India as of December 2020 was 47.3 million.

2. Family Floater Health Insurance Policy

Family floater insurance covers the policyholder’s complete family, including their spouse and children. The coverage covers any family member’s medical expenditures up to a certain level. There were 24.5 million family floater health insurance plans in place as of December 2020 in India.

3. Group Health Insurance Policy

Group health insurance plan coverage is given at a low premium cost to a group of people, often workers of a corporation. The policy covers hospitalization charges, medical bills, and other healthcare expenses. In India, the number of people covered by group health insurance coverage was 81.8 million as of December 2020.

4. Senior Citizen Health Insurance Policy

Senior citizen health insurance policies are designed to meet the medical demands of the elderly. These policies cover age-related illnesses as well as pre-existing medical issues that are not covered by standard health insurance policies. According to a 2016 National Sample Survey Organization (NSSO) survey, just 14% of Indians aged 60 and up have health insurance coverage.

5. Critical Illness Health Insurance Policy

Critical illness health insurance policy cover certain critical illnesses such as cancer, heart attack, and stroke. When a sickness is diagnosed, the insurance pays out a lump sum payment that may be used to cover the expense of medical care. In India, there were 4.4 million critical illness health insurance plans in place as of December 2020.

6. Disease-certain Health Insurance Policy

These policies are intended to cover the costs of treating certain ailments such as diabetes or hypertension. The overall premium collected for disease-specific health insurance coverage in the fiscal year 2019-2020 was Rs. 1.22 billion, according to the IRDAI.

By taking these variables into account, you may select a health insurance plan that meets your needs and offers comprehensive coverage at an accessible price. It is crucial to remember that the coverage and benefits provided by each insurance might differ significantly. As a result, before acquiring any health insurance policy, it is critical to thoroughly study the policy paperwork and understand the terms and conditions.

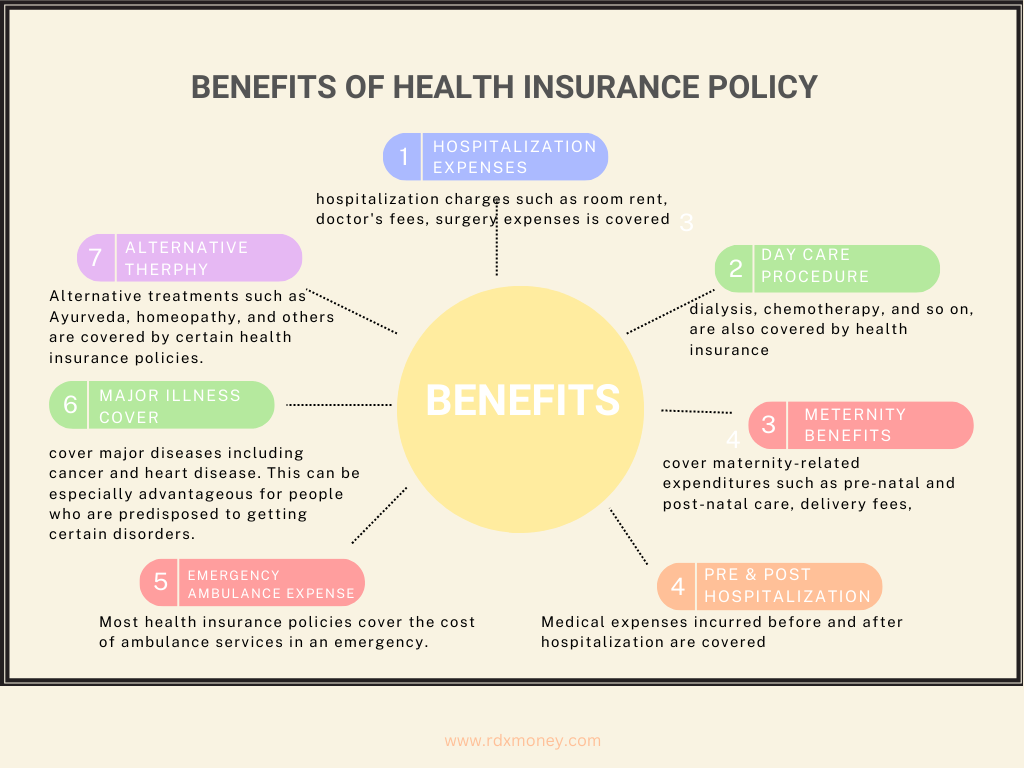

Benefits of Health Insurance

1. Hospitalization Expenses

A health insurance plan covers hospitalization charges such as room rent, doctor’s fees, surgery expenses, and so on. This is especially vital if you need to be hospitalized due to a major illness or injury. Hospitalization expenditures accounted for 53.5% of overall health spending in India, according to the National Health Accounts Estimates for India (2016-17).

2. Day-care Procedures

Day-care operations that do not need hospitalization, such as dialysis, chemotherapy, and so on, are also covered by health insurance policies. Normally patients spends specific time to get the treatment and return back to their residence and again go when the scheduled date for the treatment is there.

3. Pre & Post Hospitalization charges

Medical expenses incurred before and after hospitalization are covered by health insurance policies. Consultation expenses, diagnostic tests, medications, and so on are all included.

4. Maternity Benefit

Health insurance policies cover maternity-related expenditures such as pre-natal and post-natal care, delivery fees, and so on. Women in India are entitled to 26 weeks of paid maternity leave under the Maternity Benefit (Amendment) Act of 2017. In India, health insurance policies frequently cover maternity-related expenditures such as pre-natal and post-natal care, delivery fees, and so on.

5. Emergency Ambulance Service

Most health insurance policies cover the cost of ambulance services in an emergency. This a important benefit as transporting the patient is very important and can make a critical difference between life and death. By providing this benefit in health insurance policy is a critical one.

6. Major Illness Coverage

Many health insurance policies cover major diseases including cancer and heart disease. People who are diagnose with certain disorders have advantage due to these insurance policy. Noncommunicable diseases (NCDs) account for 61% of all fatalities in India, according to the Indian Council of Medical Research. Health insurance policies that cover critical diseases such as cancer, heart disease, and others might assist patients in dealing with the financial burden of these conditions.

7. Alternative Therapies

Some health insurance polices does not cover alternative treatments such as Ayurveda, homeopathy. According to a 2019 assessment undertaken by the Ministry of AYUSH, the Indian Ayurveda business is worth around USD 4.4 billion. Alternative therapies such as Ayurveda, homeopathy, and others are covered by health insurance programs, giving patients more alternatives for their healthcare requirements.

When selecting a health insurance plan, think about the features and coverage options that are most important to you. Make sure you carefully study the policy documentation and understand what is and is not covered by the plan.

Factors to consider while choosing health insurance

Considerations When Choosing a Health Insurance Plan Choosing the best health insurance plan may be difficult, especially with so many alternatives on the market. It is critical to select a strategy that meets your specific requirements and budget. Here are some things to think about while choosing a health insurance plan:

1. Coverage

The first and most important item to evaluate is the health insurance plan’s coverage. As of September 2021, health insurance coverage in India covered only about 19% of the population, indicating that a small portion of the population has health insurance coverage. It is crucial to carefully review the policy and comprehend what is included and excluded. Some plans simply cover hospitalization, while others include outpatient treatment, prescription medicines, and preventative care.

2. Network

Determine whether the health insurance plan has a preferred network of hospitals and healthcare providers that will give options to choose the best one you think. As of March 2021, the government-run Ayushman Bharat initiative in India had appointed over 24,000 hospitals and healthcare institutions across the country, covering over 10.7 crore families. If your preferred healthcare provider is not in the network, you may incur greater out-of-pocket costs.

3. Deductibles & Premium

Compare the rates and deductibles of several health insurance policies available in the market and choose the one where the premium & deductibles is less but not the features provided by the plan. In India, the average individual health insurance premium in 2019-20 was Rs 5,731, while the average family floater plan cost was Rs 11,990. A higher premium might result in reduced out-of-pocket spending, but a larger deductible could result in cheaper premiums.

4. Pre-existing Conditions

Make sure your health insurance plan covers pre-existing conditions or when you inform them it doesn’t affect the overall insurance plan. According to the Insurance Regulatory and Development Authority of India (IRDAI), health insurance firms in India cannot refuse coverage to anyone who has pre-existing diseases. However, waiting periods may apply before coverage begins, and some illnesses may be excluded from coverage.

5. Co-pay & Coinsurance

Investigate the co-pay and coinsurance fees for various procedures. IRDAI rules require health insurance contracts in India to include a co-payment provision, which means that the policyholder must bear a specified proportion of the claim amount. The co-payment might range from 10% to 30%, depending on the insurance conditions and the policyholder’s age.

6. Customer Service

Finally, assess the health insurance company’s customer service which is very important as and when you need assistance from the insurance company. As of March 2021, the IRDAI had received around 27,000 complaints against health insurance providers in India. Make certain that the firm you select has a strong reputation for addressing customer concerns and giving support when necessary.

By taking these variables into account, you may select a health insurance plan that meets your needs and offers comprehensive coverage at an accessible price.

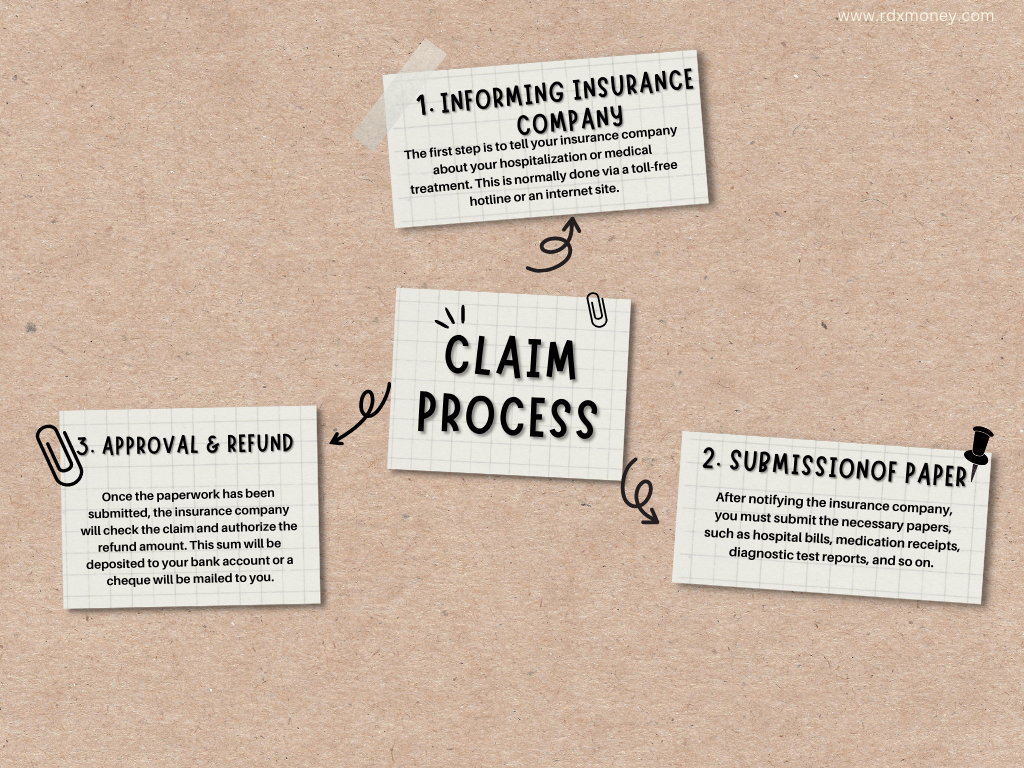

How to file a health insurance claim

Filing a health insurance claim is a crucial part of using your policy when you need it. The following are the actions to take while making a claim:

1. Informing your insurance company

: The first step is to tell your insurance company about your hospitalization or medical treatment. The whole process is via online or Toll free number. Hospitals sometimes send the details of the procedure to the insurance company for prior approval, making the whole process easier

2. Submit proper documents

After notifying the insurance company, you must submit the necessary papers, such as hospital bills, medication receipts, diagnostic test reports, and so on. Make sure to thoroughly read the policy documentation and comprehend the needed documents before submitting a claim. These days, cashless insurance also assists patients, as the hospital insurance division submits the entire bill and with pre-approval already there approval of the final bill comes fast and patient is free to leave after necessary paper work.

3. Approval & Refund

Submit the proper insurance paper, the insurance company will check the claim and authorize the refund amount. A mail will come when the to confirm the transfer of money to your account. Today in india systems are more robust and these approval happens very fast and the hospital get confirmation of the amount which will be paid to them by insurance company. Bases that they also inform patient and both can have a peace of mind about settling the bills.

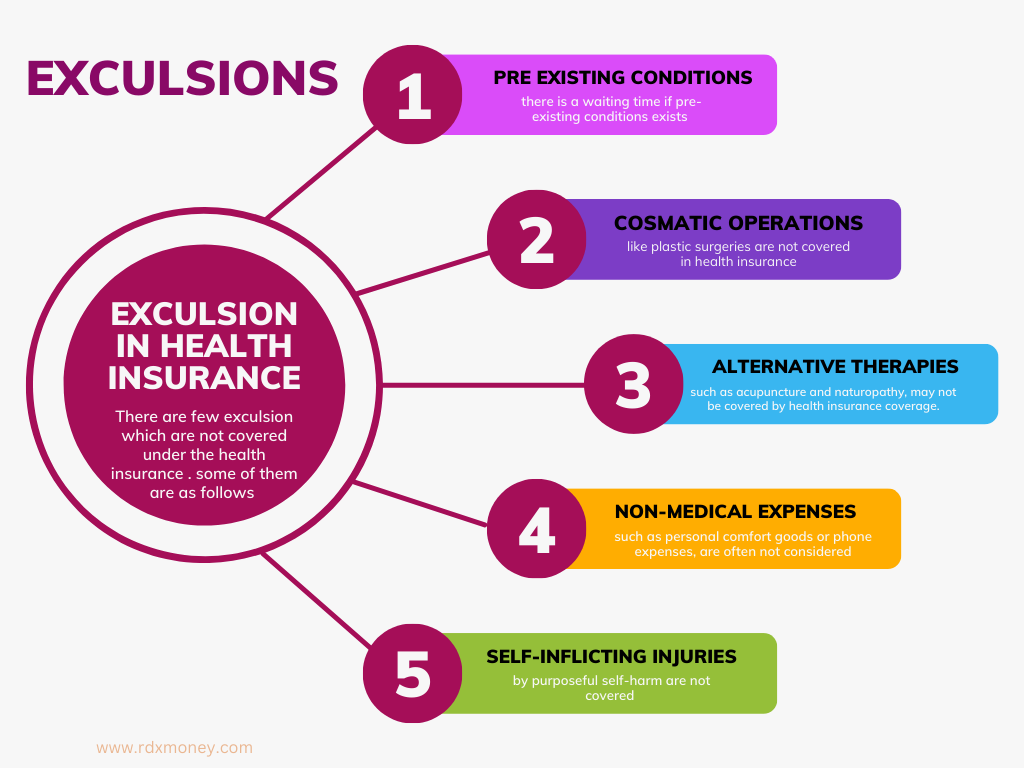

Exclusions in health insurance policy

There are some exclusions also in the health insurance. Here are some examples of common exclusions:

1. Pre-existing conditions

Most insurance offers a waiting time for pre-existing conditions. This waiting period before insurance coverage begins is applicable for pre-existing medical conditions, which means that any medical conditions that exists before purchasing the coverage will only start after a set period of time. For instance, if you have diabetes, your insurance coverage will start after 2 to 4 years.

2. Cosmetic Operations

Health insurance plan does not cover cosmetic operations. This is mainly because it is consider a elective or a optional procedure and not medically necessary by doctors. These are personal choice and not a suggestion from doctor as standard practice.

3. Alternative Therapies

Health insurance coverage may not cover some alternative therapies, such as acupuncture and naturopathy. Insurance providers do not consider these therapies as standard medical treatments as effectiveness of these treatments are not medically establish.

4. Non Medical Expenses

Non-medical reasons, such as personal comfort goods or phone expenses are not medical expenses hence not a part of health insurance plan. They are of personal nature and provides comfort for patient.

5. Self-inflicting Injuries

Health insurance coverage does not cover injuries caused by purposeful self-harm because they are preventable and within the control of the individual. These injuries are intentionally, and therefore not covered.

Typical exclusions and the claims procedure is to make the most of your health insurance coverage and effective in protecting you in case of a medical emergency. The Insurance Regulatory and Development Authority (IRDA) in India requires insurers to satisfy claims within 30 days after receipt of all paperwork. Furthermore, according to a National Sample Survey Organization (NSSO) estimate, just 19% of the Indian population has some type of health insurance, indicating a huge coverage gap.

Conclusion

In conclusion, health insurance is a shield to cover unexpected health wise issues coming in the future and an important part of financial planning, especially in a nation like India where healthcare expenditures are continually growing. We have discussed different elements of health insurance in this article, including its definition, kinds, benefits, coverage alternatives, and typical exclusions. We also gave advice on how to select the best health insurance plan.

It is critical to understand that not having health insurance might cause severe financial pressure in the event of an unforeseen medical emergency. A single hospitalization incident might deplete a person’s funds and leave them in a financial bind. Health insurance may bring financial stability and peace of mind in India, where out-of-pocket payments make for a major amount of healthcare spending.

In the end, we strongly advise consumers to prioritize health insurance as part of their financial planning and safety net for you and your family. Individuals may protect themselves and their families from the financial burden of healthcare expenditures by selecting the correct health insurance plan and ensuring access to excellent healthcare services when needed.

Frequently Asked Questions

No, it is not currently mandatory to have health insurance in India. However, the government has launched various health insurance schemes and encourages individuals to purchase health insurance for financial protection against medical expenses. Some employers also provide health insurance as a benefit to their employees.is maternity comes under health insurance

Health insurance in India does cover maternity expense but typically enforce a waiting period of 2 to 4 years before policyholders can avail themselves of maternity benefits.

Yes, you can switch to a different health insurance provider while your policy is still active. Porting is the process name, and it allows you to transfer your policy from your current insurer to a new one without losing your accumulated benefits.

A co-pay is a cost-sharing arrangement between the insurance policyholder and the insurance company. It mandates the policyholder to pay a fixed percentage of the medical expenditures incurred, with the balance covered by the insurance company. For example, if a policyholder has a 10% co-pay, they will pay 10% of the medical cost, while the insurance company would cover the other 90%.

Yes, having health insurance can provide tax benefits in many countries, including India. Under Section 80D of the Income Tax Act, premiums paid towards health insurance for self, spouse, dependent children, and parents are eligible for tax deductions.

Coinsurance is a cost-sharing agreement between the insured and the insurer in which the insured pays a portion of the covered medical expenditures and the insurer covers the rest. The percentage split is typically represent as a ratio, such as 80/20 or 70/30.